Healthy Families Act Accrual Plan Setup

How to Set up an Accrual Plan Based on Hours Worked

- If the beginning of the year is the same for your part-times as it is for your full-times, go to step 2. If it is not, you will need to set up a new Hours Category and new Sick Earned and Sick Taken hours codes. After setting up the new category and codes, go to step 2.

- If the beginning of the year is Anniversary, skip to step 4. If it is Fiscal or Calendar Year, navigate to Maintenance > Human Resources > Earnings Maintenance > Hours Categories to create an hours category.

- Select the Roll Date month in which your organization starts the California Part-Time Sick Year. Do not select Seniority Date, Hire Date, Benefit Date or Accrual Date, even if you are anniversary-based.

Anniversary-Based Accruals Setup

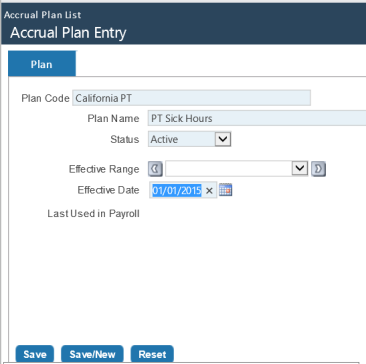

- Navigate to Maintenance > Human Resources > Employee Attributes > Accrual Plans.

- Click New to open the Accrual Plan Entry page:

- Key Entries:

Plan Code: Any code that best describes the group that will receive this Accrual Plan. This plan will be available for selection on each employee in Workforce Administration.

Effective Date: Date the accrual plan will be available for selection in Workforce. Later, as Create Event is used, it will dictate which plan is in effect when you run Calculate Accruals.

- Click Save. The Profile tab will appear.

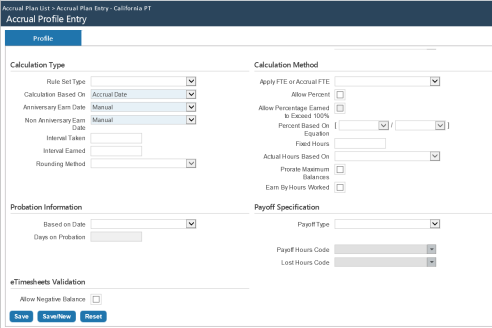

- Click the Profile tab.

- Click New to start a new accrual profile:

- Key Entries:

Calculation Type

Rule Set Type: Tells the system what date type to use for Calculate Accruals and Hours Entry Maximum Earnings. Select one of the following four date types: Accrual Date, Benefit Date, Hire Date or Seniority Date. If none of these apply, use Exception. If you leave this field blank, only one rule set will be created on the Rule Sets tab.

In the case of California Part-Time Sick Hours, leaving this field blank will be the norm.

Calculation Based On: Determines the months of service an employee has. Select one of the following four: Accrual Date, Benefit Date, Hire Date or Seniority Date.

Anniversary Earn Date and Non-Anniversary Earn Date: Work date Calculate Accruals will use. Though both entries are required, only one may be used.

Select from the following: Accrual Date, Benefit Date, First Day of Pay Period, First of the Month, Hire Date, Last Day of Pay Period, Last Day of Month, Manual, Seniority Date.

If you select Manual, Calculate Accruals will use the date filled in on the Calculate Accruals screen. If you select any other date, Calculate Accruals will ignore the date filled in on the screen and use the date selected.

Interval Taken and Interval Earned: Tell the system how time can be taken and earned. If you leave either field blank, all four decimals will be used; however, you may enter 0001 up to 1.0000.

Examples: An entry of 1.0000 would represent a whole number and would expect and use a whole number. An entry of .25 would expect and use .25, .50, .75 and 1.00 but not .3333.

Rounding Method: Once you have filled in the Interval Taken or Interval Earned, determines the type of rounding: Round Down, Round Up or Standard Rounding.

In the case of California Part-Time Sick Hours, the Interval Taken and Interval Earned are expected to be blank.

Probation Information

Based On Date: Determines an employee’s days on probation. Select one of the following four: Accrual Date, Benefit Date, Hire Date or Seniority Date.

Days on Probation: Number of days the employees in this profile are on probation. They can earn time but cannot use time until after the Days on Probation.

In the case of California Part-Time Sick Hours, 90 days are expected; however, to accommodate the non-consecutive 90 days, a new field, Accrual Probation End Date, is available on the Jobs tab in Workforce. This field will show only show for employees who have the Earn by Hours Worked selected.

Hours Category: Accrual category, such as vacation or sick time, of the plan profile. All related hours codes are tied to this category.

In the case of California Part-Time Sick Hours, the category of Sick is expected, but another could be used.

Hours Code: Hours code for the selected Hours Category—for example, Sick Time Earned. The field drop-down contains all hours codes that have the Accruals check box selected in Maintenance. This selection is required.

Calculation Method

Earn by Hours Worked: Requires selection for California Part-Time Sick Hours. Once selected, other fields will be available to be filled in.

- Click Save. The Rule Sets tab will appear.

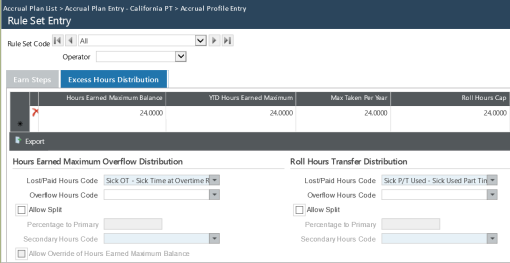

Rule Sets

- Click the Rule Sets tab.

- Click New:

Since Earned by Hours Worked is selected, a new column, Hours Worked, will appear.

California part timers can earn 1 hour per 30 hours worked. Up to 24 hours may be earned and used per year.

A year is determined in one of three ways: calendar, fiscal or anniversary. The law did not indicate what the year needed to be, so the system will allow you to select the year that is right for your organization.

We treat calendar and fiscal years the same. If you are using calendar or fiscal year, you will need to set the Roll Date on the category for the month that starts the new year. This step will be explained at the end of this document so you will not need to leave the Accrual Plan.

If anniversary is to be used, Annually is available on the Anniversary Calculation drop-down.

- Key Entries:

Anniversary Calculation: If the Earned by Hours Worked is selected, only Annually will be available. If your organization is to have the part timers earn and use their hours by their anniversary, select Annually; otherwise, leave the field blank.

Anniversary Date Type: Determines an employee’s anniversary. Select one of the following: Accrual Date, Benefit Date, Hire Date or Seniority Date.

Do not select None; it does not pertain to this calculation.

Hours Worked: Number of hours an employee needs to work before earning any time. Appearing when Earn by Hours Worked is elected, this column is new.

In the case of California Part-Time Sick Hours, 30 hours is expected in this field.

Hours Earned: Number of hours to be earned.

In the case of California Part-Time Sick Hours, 1 hour is expected in this field.

Minimum Hours: Minimum hours required to be worked in a pay period before this time may be earned.

In the case of California Part-Time Sick Hours, this field is expected to be blank.

- Click Save.

- Click the Excess Hours Distribution tab.

Max Taken per Year is a new column (explained below).

- Key Entries:

Hours Earned Maximum: Maximum number of hours an employee may have in the bank at any one time.

In the case of California Part-Time Sick Hours, 48 hours are allowed, since up to 24 hours may be rolled over. If 24 hours are the most allowed, enter that number.

YTD Hours Earned Maximum: Maximum number of hours an employee may earn in one year.

In the case of California Part-Time Sick Hours, 24 hours is the most likely entry.

Max Taken per Year: Maximum number of hours allowed to be taken per year within this category.

In the case of California Part-Time Sick Hours, 24 hours is the most likely entry.

The Hours Earned Maximum Overflow Distribution section requires you to fill in a Lost/Paid Hours Code, but it will not be used. The hours will max at the Max Taken per Year when accruals are calculated.

The Roll Hours Transfer Distribution section requires you to fill in a Lost/Paid Hours Code, but it will be used only if you roll over this category and plan.

That concludes an Anniversary-based accruals setup. If your organization uses Calendar or Fiscal Year, follow the steps in the next section.

Calendar- or Fiscal Year-Based Accruals Setup

-

Navigate to Maintenance > Human Resources > Earnings Maintenance > Hours Categories:

- Select the Roll Date month in which your organization starts the California Part-Time Sick Year. Do not select Seniority Date, Hire Date, Benefit Date or Accrual Date, even if you are anniversary-based. They are not applicable for this setup.

- If this setup is different from what you need for your full timers, you will need to create a new Sick Category and Sick Earned and Taken hours codes.

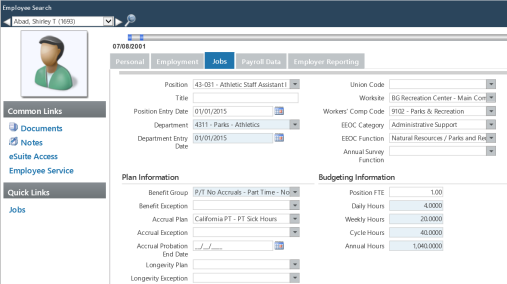

Employee Setup in Workforce Administration

Now that the accrual plan is set up, the applicable employees need the plan selected on their Jobs tabs in Workforce.

- Using the Employee Search, search for all of the benefit groups or departments for which this plan is applicable.

- Select the first employee.

- Select the Jobs tab.

- Highlight the primary job.

- Click Create Event. If necessary, you may back date the event date.

- Edit the primary job:

- Select the appropriate Accrual Plan.

- The Accrual Probation End Date shows only if the Accrual Plan has the Earn by Hours Worked selected. If the employee’s probation period is nonconsecutive, you will need to enter when the probation period will end; otherwise, the setup on the plan will be used.

- Click Save.

- Navigate to the next employee. If you click the right arrow after the employee’s name, you will be taken to the next employee who matches the selection criteria you used in the Employee Search. You also may click the magnifying glass and type the employee’s name or number. Either method will take you to the Jobs tab for the next employee.

Note: If you use the magnifying glass, you will lose the employee list the original search generated on the drop-down.

- You may need to have a separate Sick Taken for this plan so the system can determine the Hours Worked for the year. The system will look at all the hours codes that have Apply to Accruals selected. If Sick Taken has Apply to Accruals selected, you will want to use that hours code for these employees. Those hours would then be counted towards the 30 hours worked to get 1 hour.

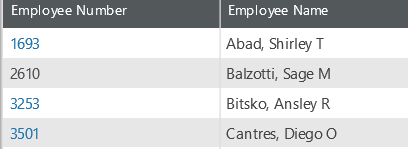

1693 Hire Date 7/8/01 Hours analysis = zero

3253 probation end date 5/30/2015, Hire Date 4/30/2015 Hours Analysis = zero

3501 Accrual Date 1/17/2014 Hours analysis = 203.50

2610 accrual date 4/1/2015, all others 8/6/2007

Hours Analysis = Hours Worked 1000.75

Sick P/T Used 15.75

3651 Hire Date = 4/22/2015

Prob Date 30 days